Buying a home is a big step. But it's more than just a place to live; homeownership is an investment that will help you improve your financial well-being in the long run. While owning a home can have challenges, the homeowner benefits that accompany purchasing...

Learning Center

Our experienced team provides the answers you need for your home loan, from programs and tools, to trends and finances.

Purchasing a Home

Feel comfortable and confident when buying a home with an affordable loan.

Refinancing a Mortgage

Make your home more affordable and accomplish other financial goals by refinancing.

First Time Home Buyer

Learn where to start when making your first major investment in a home

Veteran Mortgage Loans

Get the most from your VA benefits by learning about the home loan programs available.

Mortgage Calculators

Estimate what you can afford for your home with our mortgage calculator tips

FHA Loans

Afford your home with comfort and flexibility through the benefits of FHA loan programs.

Mortgage Rates and Trends

See where rates are headed by understanding current mortgage rates and trends.

Personal Finance

Make life affordable with personal finance tips and the right home loan.

9 Home Loan Benefits Veterans Are Eligible For

The VA home loan benefits program first began helping military service members with home buying in 1944. As part of the "GI Bill," the Servicemen's Readjustment Act was signed into existence in 1944, shortly before the end of WWII. Since then, VA home loan benefits...

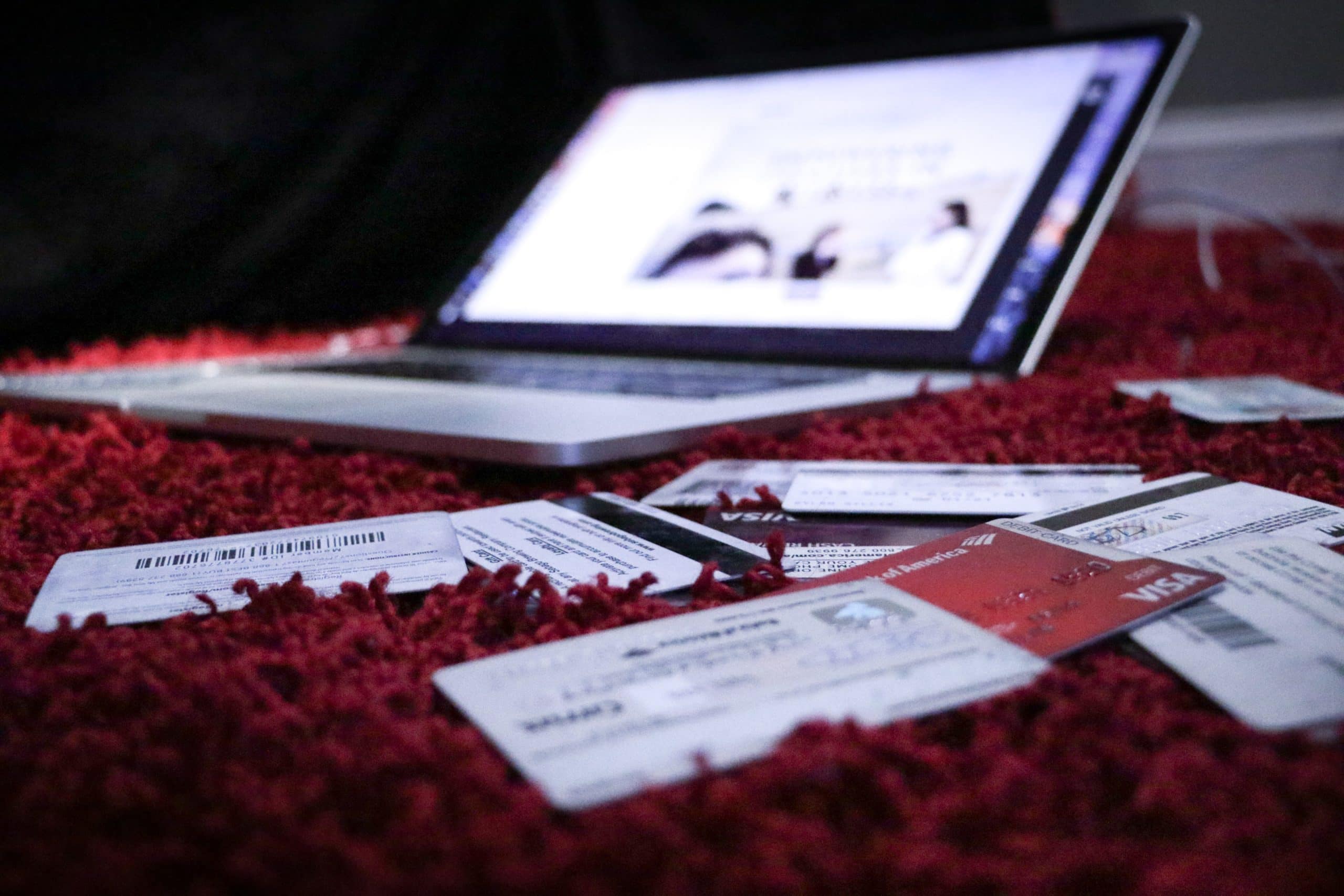

5 Mistakes to Avoid When Consolidating Debt

After staring at a growing pile of bills, you've decided to get ahead of the situation through a debt consolidation loan. Compiling various current unsecured debts into a single, more manageable monthly payment can reduce some of the stress you're feeling. It can also...

When to Buy a House? Purchasing a House in Your Twenties

It used to be that home purchasing was something you did later in life after you establish yourself in your chosen career. But Gen Z is challenging that long-held belief by becoming the newest group to get into the home buying club. So how do you know if buying a home...

Steps of Purchasing a Home From Start to Finish

Deciding to buy a home is one of the most significant decisions most people ever make. It's also one of the main ways most Americans build their retirement savings. But unlike most other retirement investments, you get to build wealth while using your home every...

7 Steps to Purchasing Your First House

Purchasing your first house can seem like you're trying to do a million different things at once. So it's no wonder some first-time homebuyers feel overwhelmed or worried they might make a mistake. This blog post will look at popular purchasing first house steps...

How Much Should a First-time Homebuyer Put Down?

The more money you have available to use as a downpayment, the less of a mortgage you will need. But how much is really enough? Saving money to buy your first home can seem like an impossible task, but a first-time homebuyer down payment may not need to be as big as...

Complete Guide to Debt Consolidation

This debt consolidation guide is intended for anyone who wants to bring their debt payments under control but unsure of the available options. In this debt consolidation guide, we'll dig into four key areas: What is debt consolidation? When should you...

What is FHA Streamline Refinance?

FHA streamline refinance refers to a mortgage refinancing program backed by the Federal Housing Administration (FHA). "Streamline" refers to the reduced documentation and underwriting requirements. An FHA streamline refinance loan requires less credit documentation...

Pros and Cons of Debt Consolidation

The New York Federal Reserve recently released its Quarterly Report on Household Debt and Credit. In it, they reported consumer debt in the United States increased by more than $85 billion in the third quarter of 2020, hitting an all-time high of $14.35 trillion. With...